Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

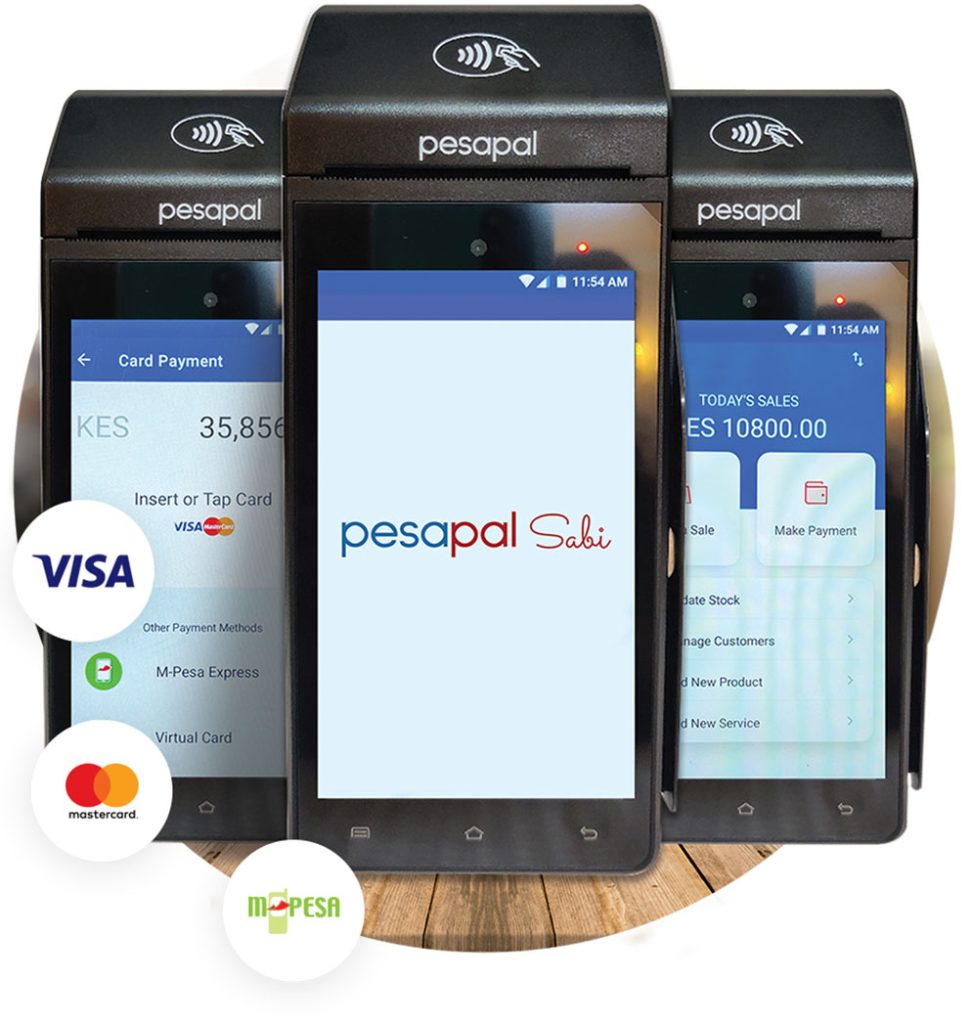

Sabipay, the local arm of Pesapal, has successfully obtained a Payments System Business license from the Bank of Zambia.

This milestone is expected to revolutionize the way businesses and consumers engage with electronic payments across the country.

With this new license, Sabipay aims to provide a range of tailored payment solutions that cater to the diverse needs of Zambian users.

The newly acquired license allows Sabipay to facilitate various payment methods, including online transactions, in-store payments via mobile money, and card payments.

This capability is set to enhance the efficiency and inclusiveness of Zambia’s electronic payments ecosystem, making it easier for both businesses and consumers to conduct transactions.

Agosta Liko, CEO of Pesapal Limited, expressed enthusiasm about this achievement, stating, “We are thrilled to receive the Payments System Business license from the Bank of Zambia.

This achievement reinforces our commitment to expanding our footprint in the region and underscores our dedication to fostering financial inclusion and economic growth.”

With this license, Sabipay is poised to transform the financial transaction landscape in Zambia.

The introduction of Sabipay in Zambia is expected to create a ripple effect across various sectors.

Small retail shops will now have the opportunity to accept mobile payments, while larger enterprises can benefit from robust online payment gateways.

This versatility ensures that businesses of all sizes can manage their payments seamlessly across multiple platforms, enhancing the overall customer experience.

For consumers, the availability of a reliable and versatile payment system means greater convenience and more options.

Whether making purchases in-store, shopping online, or utilizing mobile payment solutions, Sabipay’s offerings are designed to simplify transactions.

This ease of use is anticipated to drive higher adoption rates of electronic payments among Zambians, further integrating the digital economy into their daily lives.

Read Next: Zambian Startup Bosso Raises $400k in Early Funding for E-Commerce Construction

The launch of Sabipay is particularly significant in promoting financial inclusion in Zambia.

By providing accessible and user-friendly payment solutions, Sabipay aims to bridge the gap for unbanked and underbanked populations.

This initiative aligns with broader efforts to enhance economic growth and empower individuals through better financial services.

As Sabipay begins operations under its new license, it is committed to fostering an inclusive financial ecosystem that supports the needs of all Zambians.

The company’s focus on innovation and customer-centric solutions is expected to play a crucial role in driving the adoption of electronic payments in the country.

The successful licensing of Sabipay marks a pivotal moment for Pesapal in its quest to expand its regional presence.

As the fintech landscape in Zambia evolves, Sabipay is well-positioned to lead the charge in transforming payment solutions.

The company’s commitment to innovation and customer service will be critical as it navigates the competitive environment of electronic payments.

With the launch of Sabipay, Zambia is set to witness exciting changes in its financial services sector.

The integration of advanced payment technologies will not only enhance the efficiency of transactions but also stimulate economic growth by enabling greater participation in the digital economy.

The acquisition of the Payments System Business license by Sabipay, Pesapal’s Zambian branch, represents a significant step forward in the evolution of electronic payments in Zambia.

By providing tailored solutions for businesses and consumers alike, Sabipay is poised to make a lasting impact on the financial landscape, driving financial inclusion and fostering economic development in the region.

Was this information useful? Drop a nice comment below. You can also check out other useful contents by following us on X/Twitter @siliconafritech, Instagram @Siliconafricatech, or Facebook @SiliconAfrica.