Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

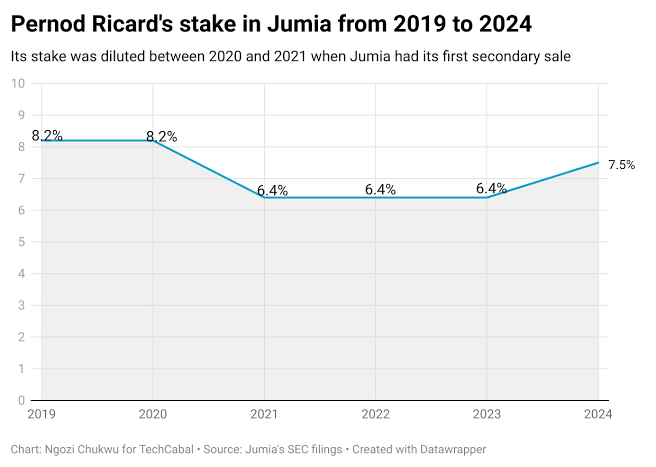

Pernod Ricard, the world’s second-largest wine and spirits seller, renowned for its iconic brands like Jameson, has made a significant investment in the African e-commerce platform Jumia.

The spirits seller acquired 1.27 million shares in Jumia’s recently announced secondary sale, increasing its stake from 6.4% to 7.5%.

This move underscores Pernod Ricard’s confidence in Jumia, despite recent fluctuations in the company’s stock performance.

The exact price at which Pernod Ricard purchased the new shares remains undisclosed.

However, Jumia’s stock (JMIA) was trading at approximately $4.68 on August 6, the day the acquisition was made.

Based on this price, it is estimated that Pernod Ricard invested around $6 million in this transaction.

This investment reflects the spirits seller’s long-standing relationship with Jumia, as it previously held a more substantial stake of 8.2% before dilution occurred due to the retailer issuing additional shares between 2020 and 2021.

See also: Jumia Reaches its Funding Target with a $99.6 Million Raise

The acquisition comes at a time when Jumia’s share price has faced challenges, particularly after the company reported disappointing revenue figures for the second quarter of 2025.

Concerns regarding share dilution from secondary sales have also weighed on investor sentiment.

Despite these challenges, Jumia’s stock experienced a remarkable 252% increase in July 2024, pushing its market capitalization to approximately $1.3 billion.

This surge was attributed to improved cash efficiency and a strategic restructuring of the business model.

In an effort to stabilize its operations, Jumia has undertaken significant cost-cutting measures.

In February 2023, the company laid off 900 employees and reduced executive compensation.

Additionally, in December 2023, Jumia shut down its food delivery service, Jumia Food, which had been a financial drain.

These efforts appear to be yielding positive results, as Jumia’s Q2 2025 report indicated a narrowing of losses to $19 million, a significant improvement compared to the same period in 2023.

See also: Uber Hits Massive Profit with Increased Bookings

Jumia’s financials for 2025 also reveal a notable increase in user engagement. The company reported 4.8 million orders, even while reducing advertising expenditures.

Jumia attributes this growth to enhanced search engine optimization (SEO) and improved customer relationship management strategies.

The platform currently boasts 2 million active users quarterly, a promising metric for Pernod Ricard, which utilizes Jumia for direct distribution of its products as well as through third-party sellers across Africa.

Read Next: Jumia Market Cap Surpasses $1 Billion

Pernod Ricard’s increased stake in Jumia signals a strategic vision that aligns with the growing e-commerce landscape in Africa.

The spirits seller’s investment reflects a belief in the long-term potential of Jumia as a key player in the region’s online retail market.

By strengthening its position in Jumia, Pernod Ricard aims to leverage the platform’s expanding user base and enhance its distribution capabilities throughout the continent.

The spirits seller has not provided further details regarding the investment, and Jumia has not responded to requests for comments.

Nonetheless, this acquisition is a clear indication of Pernod Ricard’s commitment to the African market and its confidence in Jumia’s ability to navigate the challenges it faces.

As the e-commerce sector in Africa continues to evolve, the partnership between Pernod Ricard and Jumia may pave the way for innovative strategies that benefit both companies and their stakeholders.

With the spirits seller’s backing, Jumia could potentially strengthen its market position and enhance its operational efficiency, ultimately driving growth in a rapidly changing retail environment.

Was this information useful? Drop a nice comment below. You can also check out other useful contents by following us on X/Twitter @siliconafritech, Instagram @Siliconafricatech, or Facebook @SiliconAfrica.