Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Nigeria’s economic trajectory is deeply influenced by the inflation rate, a vital indicator reflecting the general increase in prices of goods and services. In 2024, the nation’s inflation rate will play a central role in shaping fiscal policies, influencing consumer behavior, and guiding the actions of the Central Bank of Nigeria (CBN).

This article delves into the nuances of Nigeria’s inflation rate in 2024, exploring its causes, effects, and the pivotal role played by the Central bank of Nigeria in maintaining economic stability.

To comprehend the impact of Nigeria’s inflation rate in 2024, it’s crucial to understand the concept of inflation. Inflation represents the continuous rise in the overall price levels of goods and services over time.

This dynamic economic phenomenon affects consumers’ purchasing power, altering spending habits and investment strategies. As of 2024, inflation becomes a key barometer, reflecting the intricacies of supply and demand, government policies, and global economic forces.

Nigeria’s inflation rate is typically measured through indices, with consumer price indices (CPI) and producer price indices (PPI) serving as vital indicators.

Consumer prices reveal the cost of a basket of goods and services, showcasing the impact on everyday expenditures, while producer prices highlight changes in input costs for businesses, influencing production and pricing strategies.

The nuanced dynamics of inflation involve a delicate balance. Mild inflation can stimulate spending and investment, fostering economic growth.

However, unchecked inflation can erode purchasing power, disrupt financial planning, and prompt detrimental effects on savings.

As Nigeria navigates its economic landscape in 2024, a comprehensive understanding of inflation’s definition and dynamics lays the groundwork for addressing challenges and capitalizing on opportunities within the broader economic context

Read also – Just in: Flutterwave Shuts Down Disha Temporarily

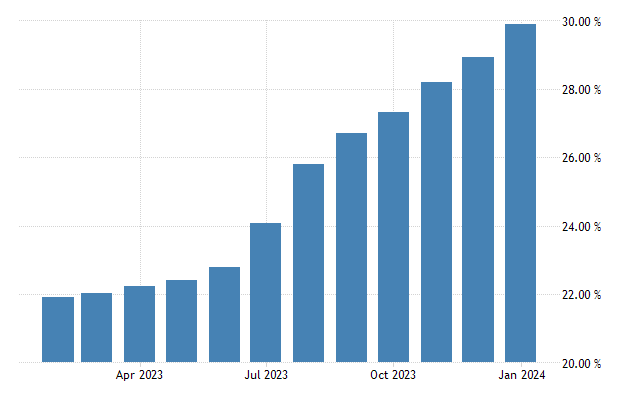

The National Bureau of Statistics’ most recent statistics show that in January 2024, the nation’s headline inflation rate increased to 29.90% percent.

The NBS stated in its Consumer Price Index (CPI) report for January 2024 that “the headline inflation rate increased to 29.90% in January 2024 relative to the headline inflation rate which was 28.92% in December 2023.”

The CPI report tracks changes in the pricing of goods and services.

“Observing the change, the headline inflation rate for January 2024 increased by 0.98% points in comparison to the headline inflation rate for December 2023.

Similarly, compared to the rate of 21.82% reported in January 2023, the headline inflation rate increased by 8.08% points year over year.

The NBS reports that the annual rate of food inflation was 35.41%, which is 11.10% higher than the rate of 24.32% reported in January 2023.

The NBS study stated that “increases in the prices of bread and cereals, potatoes, yam and other tubers, oil and fat, fish, meat, fruit, coffee, tea, and cocoa were the causes of the rise in food inflation on a year-over-year basis.”

The data released on Thursday follows the nation’s rising cost of living. In response to the situation, President Bola Tinubu ordered the release of grains in order to lower the cost of food in the nation.

As the country struggles with the harsh consequences of the removal of gasoline subsidies and the insecurity that has affected various parts of Nigeria, a number of stakeholders have also been convening.

Read also – Mamamoni, Female-focused Fintech in Nigeria, Receives £250,000 in Funding to Expand

Several factors can contribute to Nigeria’s inflation rate, and a comprehensive analysis is necessary to grasp its complexity. Demand-pull inflation, cost-push inflation, and built-in inflation are among the key drivers.

Understanding these factors provides insight into the economic forces at play and helps anticipate potential policy responses.

As the economy experiences growth, consumers wield greater purchasing power, stimulating demand and subsequently driving prices upward.

Cost-push inflation, another notable factor, arises from increased production costs, often triggered by external shocks such as rising global commodity prices or supply chain disruptions.

In Nigeria, the dependency on oil exports renders the economy vulnerable to fluctuations in oil prices, contributing to cost-push inflation. Additionally, built-in inflation, rooted in wage-price spirals, adds a layer of complexity.

When businesses face rising production costs, they may pass these increases onto consumers, prompting demands for higher wages and perpetuating a cycle of inflation.

These multifaceted causes necessitate a strategic response from the Central Bank of Nigeria (CBN), highlighting the importance of proactive monetary policies in addressing inflationary pressures and fostering economic stability.

Balancing these diverse factors is imperative to achieve sustainable economic growth in Nigeria amidst the intricacies of the global economic landscape.

Read also – How to Check CAO Status 2024

The Central Bank of Nigeria assumes a central role in managing Nigeria’s inflation rate.

Its monetary policies, including interest rate adjustments and open market operations, are instrumental in curbing inflationary pressures or stimulating economic growth.

To control Nigeria’s inflation rate, the CBN employs a mix of monetary policy instruments, including adjusting the monetary policy rate (MPR) and employing open market operations (OMO).

By manipulating the MPR, the CBN can influence interest rates, impacting borrowing costs and, consequently, consumer spending and investment.

Open market operations involve buying or selling government securities to regulate the money supply, influencing inflationary pressures.

The CBN’s actions are not only reactive but also proactive, aiming to strike a delicate balance between curbing inflation and fostering economic growth.

In 2024, as Nigeria faces unique economic challenges, the CBN’s decisions on interest rates, liquidity, and currency management are critical in shaping the nation’s inflationary landscape.

A comprehensive understanding of the CBN’s role reveals its significance in steering Nigeria’s economic ship through the complex currents of inflation and ensuring a stable and resilient financial environment.

The inflation rate profoundly affects consumers, altering their purchasing power and consumption patterns.

Examining how inflation influences consumer behavior sheds light on the resilience and adaptability of individuals and businesses in the face of economic fluctuations.

Nigeria’s inflation rate in 2024 inevitably extends its influence to the daily lives of consumers, reshaping their purchasing power and spending behaviors.

As prices rise, consumers grapple with the challenge of maintaining their standard of living amidst increased costs of essential goods and services.

The impact is particularly pronounced in lower-income households, where a higher percentage of income is allocated to necessities. In response to inflation, consumers often adopt adaptive strategies.

They may alter consumption patterns, shifting preferences towards more affordable alternatives or reducing discretionary spending.

Additionally, individuals might explore investment avenues to preserve the value of their savings against the erosive effects of inflation. The behavioral changes manifest not only in individual choices but also in broader economic trends, influencing market dynamics and demand-supply relationships.

Understanding how the inflation rate affects consumer behavior is crucial for policymakers, businesses, and individuals alike. It informs economic forecasts, shapes marketing strategies, and prompts adjustments in fiscal policies.

In 2024, as Nigeria’s populace navigates the challenges posed by inflation, consumer impact and behavior provides insights into the resilience and adaptability of individuals within the evolving economic landscape.

Read also – Petrocity and Spiro Set to Bring Electric Mobility to Kenya

Businesses, both large and small, navigate a dynamic economic environment influenced by inflation. The cost of production, pricing strategies, and investment decisions are all shaped by the prevailing inflation rate.

Analyzing how businesses respond to inflationary pressures provides valuable insights into the adaptability and strategies adopted within the economic ecosystem. As inflation drives up the prices of raw materials and operational inputs, businesses are confronted with the challenge of maintaining profitability without passing excessive costs onto consumers.

Pricing strategies become crucial for businesses seeking to balance competitiveness and sustainability. Some may absorb higher costs to remain price-competitive, impacting profit margins.

Others might adjust pricing, potentially influencing consumer demand. Additionally, businesses may explore operational efficiencies, renegotiate supplier contracts, or diversify sourcing to mitigate the impact of inflation.

The ripple effect extends to investment decisions as well. Increased uncertainty may prompt cautious approaches to capital expenditure, impacting expansion plans or technological investments.

For businesses involved in international trade, fluctuations in exchange rates due to inflation can add another layer of complexity.

Understanding how the inflation rate permeates the business realm in 2024 allows policymakers and business leaders to formulate adaptive strategies.

It underscores the need for resilience, innovation, and strategic planning to navigate the challenges posed by inflation and foster sustainable economic growth in a dynamic and evolving environment.

Investors are not immune to the effects of inflation, as it influences interest rates, returns on investments, and risk perceptions.

A comprehensive overview of how inflation in 2024 impacts investment decisions is crucial for individuals and institutions seeking to optimize their portfolios and navigate the financial landscape.

The inflation rate in Nigeria for 2024 significantly shapes the investment landscape, influencing decisions made by both individual and institutional investors.

One of the primary considerations for investors is the effect of inflation on real returns. As inflation erodes the purchasing power of money, investors are compelled to seek investments that outpace the inflation rate to preserve and grow their wealth.

Fixed-income securities, traditionally seen as stable investments, can be particularly vulnerable in periods of higher inflation.

Investors may turn to alternative investments like equities, real estate, or commodities, seeking assets that historically exhibit resilience against inflationary pressures.

Interest rates play a pivotal role in investment decisions. Central to the inflation-investment dynamic is the response of central banks, such as the Central Bank of Nigeria, which may adjust interest rates to manage inflation.

Higher interest rates can impact borrowing costs and influence the attractiveness of various investment avenues. For businesses, inflationary pressures can affect the cost of capital and impact profitability, influencing investment decisions.

Understanding the intricate relationship between inflation and investment is crucial for investors and businesses alike in navigating the complex financial landscape of 2024, ensuring informed decisions that align with broader economic realities.

The current Nigeria’s inflation rate is 29.90% from the National Bureau of Statistics.

Factors can include demand-pull inflation from increased consumer spending, cost-push inflation rate due to rising production costs, and built-in inflation linked to wage-price spirals.

Inflation erodes the purchasing power of money, reducing what consumers can buy with the same amount of income.

Consumers may alter spending patterns, opt for more affordable alternatives, or explore investment options to protect against the effects of inflation.

Inflation increases the cost of raw materials and operational inputs, prompting businesses to reassess pricing strategies and operational efficiency.

Inflation can influence how businesses set prices, balancing competitiveness and profitability while adapting to changing market dynamics.

Investors may diversify into assets traditionally resilient to inflation, such as equities, real estate, or commodities.

Central banks may adjust interest rates to manage inflation, impacting borrowing costs and influencing the attractiveness of various investments.

Inflation can impact the cost of capital for businesses, influencing investment decisions and potentially affecting profitability.

Businesses can explore strategies like renegotiating supplier contracts, improving operational efficiency, and adjusting pricing models to navigate the challenges posed by inflation.

As Nigeria grapples with the intricacies of its inflation rate in 2024, the role of the Central Bank of Nigeria remains pivotal in maintaining economic stability.

Understanding the multifaceted causes, the global and domestic influences, and the ripple effects on consumers, businesses, and investors is essential for informed decision-making.

In navigating the complexities of Nigeria’s economic landscape, a nuanced approach that considers the interplay of factors will contribute to the nation’s economic resilience and growth.