Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Safaricom has announced a major upgrade to its M-PESA platform, increasing its capacity to 6,000 transactions per second. This is the largest enhancement the service has seen since 2015 and marks a significant step forward for Africa’s most popular mobile money platform. The M-PESA upgrade increased capacity to 6,000 transactions to better serve the growing demands of its users and the expanding digital economy across the continent.

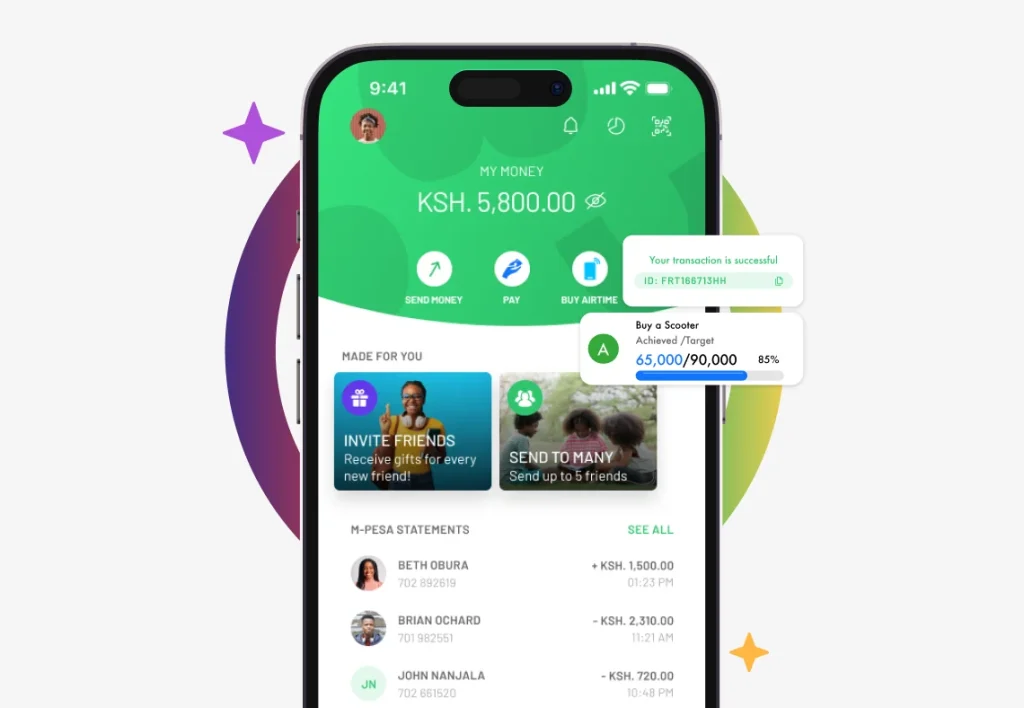

M-PESA started in 2007 as a simple money transfer service and has grown into Africa’s largest fintech ecosystem. It now supports a wide range of financial services including payments, savings, credit, insurance, remittances, and e-commerce. With millions of users relying on M-PESA daily, the increased capacity will help keep transactions fast and reliable even as the number of users continues to rise.

Read Next: Daniel Yu Steps Down as Wasoko CEO After 11 Years

The upgrade introduces the next-generation core system called Fintech 2.0. This new system not only boosts the platform’s processing ability from 4,500 to 6,000 transactions per second but also allows room for future growth, potentially reaching 12,000 transactions per second as demand increases. This means M-PESA can handle more transactions at the same time, reducing delays during peak times and improving user experience.

Safaricom has also implemented an active-active architecture, spreading the system across multiple hosting sites. This setup means the platform is more resilient and can avoid service interruptions. In real terms, customers will experience fewer downtimes and more reliable access to M-PESA services.

The M-PESA upgrade increased capacity is supported by advanced artificial intelligence technology embedded within Fintech 2.0. This AI boosts fraud detection to make transactions safer by identifying and stopping suspicious activities in real time. It also provides self-healing capabilities, which help the system recover quickly from issues, and powers real-time monitoring to keep track of performance constantly. The cloud-native design of the platform means M-PESA can scale instantly and new features can be launched faster.

Safaricom’s Group CEO, Dr. Peter Ndegwa, emphasized the importance of this bold investment by saying the upgrade is a clear commitment to innovation, resilience, and customer trust. He said moving to Fintech 2.0 unlocks a platform designed not just for today’s demands but for future opportunities. By increasing the capacity, Safaricom aims to keep M-PESA at the heart of Africa’s digital transformation.

The upgrade comes at a time when transaction volumes have been rapidly increasing. At peak hours, upward of 4,200 transactions are processed every second, showing why there was a need for expansion. Safaricom’s Chief Financial Services Officer, Esther Waititu, explained that changing customer behavior and rising transaction numbers made it necessary to improve the system to meet future trends and challenges efficiently.

Along with increasing speed and capacity, the Fintech 2.0 upgrade promises 99 percent service availability. This is a step up from past experiences where there could be a few minutes of downtime, which affected thousands of customers. The new platform also supports seamless online upgrades, preventing disruptions during updates, a contrast to the risks of impacting all users under the previous system.

Beyond handling transactions faster, this upgrade places M-PESA as a key player in supporting Africa’s growing digital economy. The enhanced system aims to empower businesses, especially small and medium-sized enterprises, with better payment options and cross-border capabilities. This positions M-PESA not just as a mobile money service but as a backbone for inclusive financial services across Africa.

Read Next: Google Plans to Build Four New Subsea Cable Hubs Across Africa, Invests $9 Million in AI Research

In summary, the M-PESA upgrade increased capacity to 6,000 transactions per second to keep up with user demand, improve reliability, and introduce AI-powered innovations. This significant step forward ensures M-PESA remains a critical tool for safe, accessible, and fast financial services for millions of Africans. Safaricom continues to demonstrate its commitment to making financial services simple and inclusive while preparing the platform for the future. The move to Fintech 2.0 promises to keep M-PESA growing as Africa’s leading fintech service in the years to come.

This upgrade is a milestone not only for Safaricom but for the entire African digital economy, as M-PESA continues to shape the future of financial inclusion on the continent. The M-PESA upgrade increased capacity to 6,000 transactions per second and set a new standard for mobile financial services, providing a faster, safer, and more reliable experience for all users across Africa.

Was this information useful? Drop a nice comment below. You can also check out other useful contents by following us on X/Twitter @siliconafritech, Instagram @Siliconafricatech, or Facebook @SiliconAfrica.