Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Capitec Bank, renowned for its customer-centric approach and innovative banking services, holds a prominent position as a leading financial institution in South Africa. To enhance accessibility, the bank has strategically positioned a widespread network of branches across the country. This article aims to delve into the branch locations of Capitec Bank, providing each location’s code. This facilitates a more convenient process for customers to locate their nearest branch.

Capitec Bank, with an expansive branch network across South Africa, caters to customers in diverse cities and towns. Below are key locations featuring Capitec Bank branches, along with their corresponding branch codes:

1. Johannesburg CBD – Branch Code: 470010

2. Cape Town – Branch Code: 470010

3. Durban – Branch Code: 470010

4. Pretoria – Branch Code: 470010

5. Bloemfontein – Branch Code: 470010

6. Port Elizabeth – Branch Code: 470010

7. Nelspruit – Branch Code: 470010

8. Polokwane – Branch Code: 470010

9. East London – Branch Code: 470010

It’s important to highlight that the branch code “470010” remains consistent across all Capitec Bank branches. This unique identifier plays a crucial role in facilitating seamless interbank transactions and transfers. It’s worth noting that while the listed locations provide key examples, there are certainly other places where you can find Capitec branches that are not covered in this list.

Capitec Bank provides a range of services. These encompass savings, loans, credit cards, debit cards, commercial banking, investment banking, and investment opportunities. Below are some of the services offered by Capitec Bank Ltd.

Capitec Bank offers Personal Loans to eligible individuals, allowing them to apply for credit amounts up to R250,000.00. The repayment period ranges from 1 to 84 months, providing flexibility based on your preferences. Upon approval, funds become instantly available.

Interest rates start at 12.9% per year, with personalized rates that may vary based on individual credit assessments. It’s important to note that interest rates may be higher for individuals with poor credit histories. The loan terms are subject to affordability checks and a credit assessment.

Capitec Bank extends home loans to individuals aged 18 to 60, providing financing for up to 100% of the home loan value. Collaborating with SA Home Loans for this service, the loans range from R100,000.00 to a maximum of R5,000,000.00. Repayment terms allow for a maximum period of 240 months.

Interest rates on home loans are contingent on your credit profile and affordability. It’s essential to consider these factors when assessing the terms of your home loan with Capitec Bank.

Capitec Bank’s credit card offers a streamlined solution for accessing both savings and credit using a single card, eliminating the need for multiple cards. The credit card comes with minimal costs, featuring a monthly account fee of R35. Holding a positive balance on your credit card even earns you interest at a rate of 4.85% per year.

This credit card provides a credit limit of up to R150,000.00 and includes insurance coverage for retrenchment, death, and illness, enhancing its overall value for cardholders.

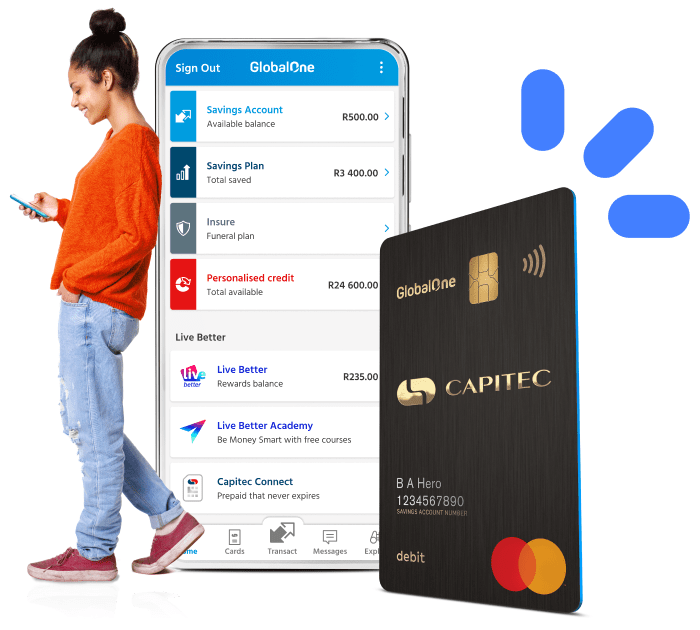

Formerly known as the Global One account, the Capitec debit card functions as a low-interest savings account, designed to simplify and make banking affordable. With over 5.5 million Capitec clients utilizing the debit card, they pay less than R50 per month in bank charges, collectively saving millions.

The Global One account boasts low charges, with countrywide and worldwide card purchases incurring no transaction fees. Withdrawals at tills cost only R1, while Capitec ATMs charge R6 per R1000 and other banks’ ATMs in South Africa charge R8 per R1000.

The versatility of the Capitec Bank debit card allows users to book flights, transact online, make payments at tills, withdraw from any South African ATM, and make international transactions. Making payments to Capitec clients is convenient, requiring only their phone number for a transaction. Additionally, users can send money to anyone in South Africa through their Global One account, with money collection available at any Checkers or Shoprite nationwide.

Capitec Bank provides various investment opportunities, including savings options such as fixed-term, tax-free, and normal savings accounts. Each account serves distinct purposes, offering different returns.

In tax-free savings accounts, both nominal and effective interest rates come into play. The nominal rate is utilized for daily interest calculation until it is capitalized at the end of the month. Subsequently, the effective interest rate is applied to the interest earned over the 12-month period of the investment.

The fixed-term savings plan allows clients to invest for periods ranging from 6 to 60 months. This plan enables clients to reinvest interest from year to year, with the potential to earn up to 8.5% interest. There is a maximum investment threshold of R20 million, and clients can start with a minimum deposit of R10,000.00.

The Capitec Bank mobile app plays a crucial role in facilitating everyday banking for customers. It allows real-time money transfers, eliminating the need to visit a physical bank. Additionally, users can conveniently apply for loans and credit cards directly through the app.

The app extends its functionality beyond Capitec Bank Ltd. customers, enabling users to send money to non-Capitec recipients for collection at Shoprite or Checkers. Other features include statement downloads, balance checks, debit order scheduling, interbank transactions, and applications for debit cards. This comprehensive suite of services makes the Capitec Bank mobile app a versatile and efficient tool for managing various banking needs on the go.

In summary, while Capitec Bank Ltd. focuses on providing affordable banking for the low and middle class, its success is evident through various achievements. With the highest customer satisfaction nationwide and assets exceeding R63 billion, the bank has emerged as a significant player in the industry.

Notably, the expansion of branches from 550 in 2017 to 850 in 2020, marking a 35% increase in just three years, reflects the bank’s rapid growth. Simultaneously, the share price soared from R700 to R1000 during the same period, showcasing the company’s robust performance and potential as a banking leader in South Africa.

However, challenges persist, particularly in the absence of business banking services for companies and the lack of private banking facilities, which could be attributed to the bank’s commitment to low interest rates and service fees. Addressing these issues might necessitate a shift from the bank’s core values.

Despite these challenges, Capitec Bank Ltd. has undeniably proven itself as a reputable company that consistently fulfills its promises. Its competitive stance has prompted a reevaluation of banking practices across the industry, ushering in exciting developments in recent years. The future looks promising for the company, with the potential to continue shaping the landscape of banking in South Africa.

How to check BVN on MTN, Airtel, GLO, and 9mobile

Latest Way to Check GOG Payslip, ePayslip 2024

How to Send Please Call Me on MTN, Vodacom, Telkom and Cell C in South Africa.