Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

A UBA loan is the best option if you’re searching for a loan with a flexible payment schedule, longer-term credit, and less equity.

A UBA loan can help you meet urgent financial demands by providing personal loans or asset financing. Through asset finance, you can also take advantage of the loan opportunity to grow your company.

In Nigeria, are you self-employed? Do you require an urgent loan to meet expenses or seize an opportunity? Consideration should be given to the UBA loan for non-salary earners.

This post will offer a thorough explanation of the UBA loan for non-salary earners, along with instructions on how to apply for and repay the loan.

Not only that, but you’ll also learn about the terms and conditions, eligibility requirements, advantages and disadvantages of the loan, and much more.

So, let’s get going now and stop wasting time!

see also: Shika Loan App: How to Apply

United Bank for Africa (UBA) provides a quick and simple credit option called UBA loan to assist people and businesses in meeting their immediate financial needs. Individuals who match the eligibility conditions can apply for the loan regardless of whether they earn a wage or not.

Personal loans, sometimes referred to as UBA Loans, are intended to be quick, easy, and simple with little paperwork needed.

see also – Shika USSD Code and Loan Application

Because of its many features and advantages, UBA Loan for Non-Salary Earners is a desirable choice for those who do not receive pay. Among them are:

UBA Loans are designed with your needs in mind. Among the general advantages are:

Among the services provided are:

Employees of respectable public and commercial organizations are eligible for this short-term financing option. With a maximum of 3 million, you can overdraw your current account by up to six months. Once your salary is received, you have thirty days to repay the loan amount plus five percent interest. Executive personal overdrafts and revolving personal overdrafts are two further categories.

Requirement: For an executive personal overdraft, an annual income after taxes of N5 million is required, and for a revolving personal overdraft, N2.5 million.

You must have received salary payments from UBA for at least three months using this account as your salary account.

Required Documents: Loan application form.

You have the chance to buy items with this loan programme that you are unable to instantly finance.

Requirement: You have to work for a respectable company in the public or private sector.

Your salary had to have been paid by them through UBA for a minimum of one month.

Documents needed: Proforma invoice and loan application form.

Personal loans offer additional funds to promptly cover unforeseen expenses or urgent necessities, such as paying medical bills or fixing your car.

Requirement: Anyone with a UBA account can apply for this type of UBA loan.

Document needed: loan application form.

This firm lends money to cooperative societies of respectable businesses, just as its name suggests. It requires a minimum of N2,000 to open and operate.

Requirement: exclusive to cooperatives of respectable businesses.

Document needed

This enables you to get credit in US dollars, euros, pound sterling, and naira. Your cash deposits, investments, and their equivalents with UBA or other finance institutions that UBA approves of are how it accomplishes this.

Requirement:

Document needed:

Make sure that every document, if needed, includes a rollover instruction.

Should the promised monetary deposit not be in your name, the following additional paperwork would be required:

Your memo or constitution the association’s articles.

a duly executed board resolution of the organisation allowing the other parties’ representatives to pledge a cash deposit to the bank.

see also – Easy Loan: How to Easily Apply

The procedures are as follows:

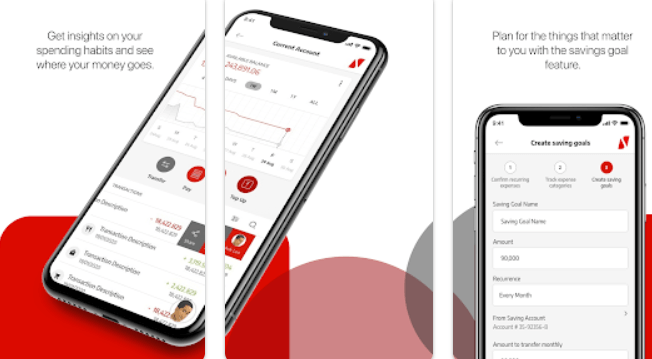

You must download the UBA mobile app to your smartphone in order to apply for a UBA loan if you do not receive an income. Both the Apple software Store and Google Play Store offer the software.

After downloading the app, use your UBA account number and any other necessary information to register and log in.

Go to the app’s loans menu and choose “Credit” to apply for UBA loans if you don’t have a job. To provide the required data, such as the loan amount, loan term, and repayment plan, simply follow the prompts.

Using a USSD code, you can also apply for a non-salary loan from UBA (learn how by reading on).

Once you have filled out all the necessary fields, submit your application to be processed.

You will receive the loan payout within 48 hours if your application is approved. Your UBA account or any other bank account you specified during the loan application procedure will receive credit for the loan amount.

Also you can;

see also – Loan Calculator and How to Use it

The requirements vary depending on the kind of loan. The section above under “What service do UBA Loans offer” lists each loan service along with the requirements associated with it.

The loan form and other documentation needed for each loan are available for download on their website or may be obtained at any branch.

If you are a non-salary earner in Nigeria and would want to apply for a UBA loan, you must fulfil the following requirements:

*919*28# is the code for the UBA loan. Once you’ve dialled, input your personal information, then the loan amount you wish to apply for, and then choose the loan term that suits you best.

Once you’ve completed all of this, simply confirm your loan request, and it will be processed.

Repayment terms range from six to twelve months, based on the loan amount and your UBA agreement. This is possible by a number of methods, such as:

It is crucial to remember that there can be major repercussions if you don’t make your payments on a UBA loan for non-salary earners, such as:

see also – Latest Ways to Link NIN with your Major Bank Account 2024

Here are some pointers to assist you properly manage your loan repayment in order to prevent missing payments on your UBA loan:

UBA loan is a financial service offered by the United Bank for Africa (UBA) that provides individuals and businesses with access to funds for various purposes, such as personal expenses, business investments, or emergencies.

You can apply online by visiting the UBA website or using their mobile banking app. The application process typically involves filling out a form and submitting required documents.

Eligibility criteria may include being of legal age, having a steady income, and meeting creditworthiness standards set by UBA. Specific requirements may vary depending on the type of loan.

You may need to provide identification documents, proof of income, bank statements, and any other documents requested by UBA to assess your eligibility.

Loan amounts vary depending on factors such as your income, credit history, and the type of loan you’re applying for. UBA offers a range of loan products tailored to different needs.

Interest rates vary depending on the type of loan, prevailing market rates, and your creditworthiness. It’s advisable to check with UBA for current rates.

Approval times vary, but some applicants receive approval within a few hours to a few business days after submitting their application and documents.

If you don’t have a job but need money quickly, the UBA Loan is an excellent choice. UBA loan for non-salary workers is a dependable source of funding for opportunities or emergencies because of its speedy disbursement, easy application process, and competitive interest rates.

Nonetheless, in order to prevent loan default, it’s critical to handle loan repayment well. Use the UBA loan code to obtain the necessary funding, or download the UBA mobile app to apply right away if you fulfil the eligibility requirements.