Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

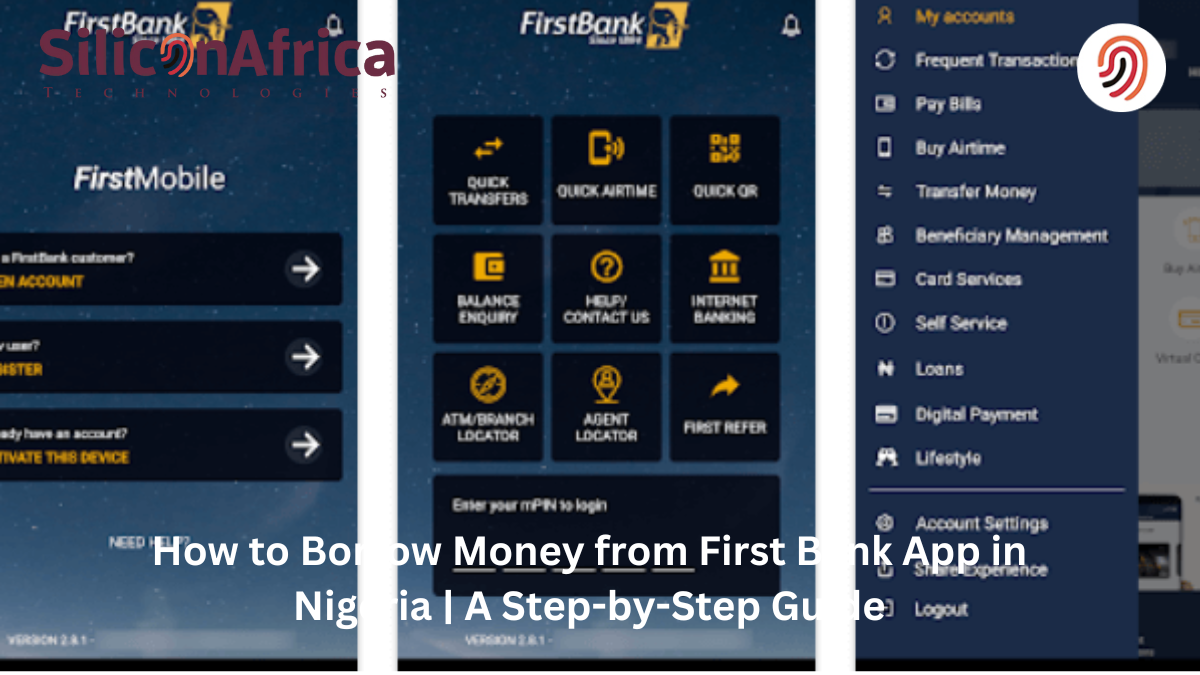

Getting a loan from FirstBank is possible, and while it may seem difficult, it’s not. We will teach you how to borrow money from your first bank account.

You might have tried different loan apps in Nigeria and are unsatisfied with their interest rate or loan offer.

If you’re a FirstBank customer, then you don’t need a loan app to give you loans.

In this article, you’ll learn how to borrow money from First Bank app, ussd code to borrow money from first bank and how to borrow money from first bank online. Let’s get started.

Also read – How to Borrow Money from Access Bank App in Nigeria | A Step-by-Step Guide

First Bank is one of the most popular banks in Nigeria, with a host of products and services to meet the customers’ needs.

First Bank loan is one of the most demanded services first bank offers.

Unlike some loan apps in Nigeria, knowing the code to borrow money from first bank account requires no collateral or guarantor.

Request and disbursement are pretty fast. In just a few minutes of applying for a First Bank loan, the money will be disbursed into your account if approved.

Note that First Bank has a variety of loans. Thereby, not all First Bank loans are available using the code, but knowing how to borrow money from first bank mobile app might be a better option.

Also read – Google Offered 300% Hike in Salary to Retain an Employee

First Bank has various types of loans to meet your financial needs. We shall discuss each one of them in much detail.

FirstCredit is a loan product that gives you money fast and hassle-free for your transactions.

You can access loans from anywhere without necessarily going to the bank, and no form of collateral or documentation is required.

You only need to know how to borrow money from First Bank app or ussd code and follow the prompt.

Whether purchasing your first home, renovating, or constructing, First bank flexible home loans will provide the financial muscle to aid your project.

If you are operating a FirstBank salary account, you may apply for a Loan Against your Salary to pay pressing bills before the next payday.

The loan tenor spans 36 months, and interest rates are quite competitive.

FirstAdvance was developed to give convenient and fast access to cash by payroll customers awaiting payment of their salaries.

This First Bank loan is available for salary earners who have received regular salaries in the last six months.

The maximum amount accessible is N500,000.00, subject to 50% of the net average three months’ salary, whichever is lower.

Also read – How to Use the African Bank Loan Calculator

The First Bank Joint Mortgage loan is designed to assist you and either your spouse or business associate acquire a property that either party could not afford to buy individually.

This product is accessible to employees in paid employment and self-employed professionals.

The loanable amount endowed with a long tenor can be obtained from this product is N70 million.

Wondering how to borrow money from first bank to purchase your dream car? First Bank Auto Loan will help you do it sooner than you think.

Businesses can also apply for this loan to acquire daily operations vehicles. The loan is also available for employees.

Firstmonie Agent Credit is designed to close the gap in providing loans to help solve liquidity challenges, thus depleting their account balances even when they have money physically on hand.

While all these loans are good means to get credit as First Bank account holder, the easiest one is the FirstCredit.

This is because you can acquire it in minutes using the First Bank loan code.

To borrow from First Bank, do the following;

With these, you are good to go for your desired loan.

However, there may be exceptions and additions, depending on the kind of loan one is applying for.

To know how to borrow money from First Bank app, do the following:

Your account is debited for management fees & VAT, interest rate, and insurance as upfront charges.

Upon receipt of salary or 30 days (whichever comes first), your account is debited for Principal repayment.

Also read – FNB Loan Calculator and how to Use it

FirstBank loan code is 894*11#. In essence, dial this USSD code to borrow money from first bank, and you will be led through the process.

You are expected to input your details, the amount of loan you want to obtain, and select your desired loan tenor.

To obtain First Bank’s loan dial *894# and select “FirstCredit”.

After doing this, you only need to confirm your loan request, and your loan will be processed.

Upon entering the above code for a First Bank loan, your loan request would be considered, and if approved, the amount would be disbursed into your First Bank account.

Use the USSD Code to borrow from First Bank Nigeria on your smartphone.

The steps are very easy; look at the simple steps highlighted below.

Your account will be debited for Management Fee, Interest Rate, and Insurance VAT, serving as upfront fees.

Since First Bank has different types of loans, the interest rates on First Bank loans are bound to vary.

You may want to log in to the First Bank website to view the current interest rate for your preferred loan type.

The rates will be subject to changes from time to time in line with the prevailing money market condition.

Immediately you secure a First Bank loan using the code, you start preparing for repayment. Therefore, let’s see how to repay First Bank loans.

Also read – How to Borrow Money from Opay Without BVN in Nigeria | A Step-by-Step Guide

To repay your First Bank instant loan, have a sufficient amount in your bank account by the due date, after which First Bank will automatically deduct the loan amount from your bank account.

You’ll then get a notification either by SMS or email showing that you have repaid the loan.

Now, with the loan repaid, you can use the USSD code to seek financial help from First Bank again.

You would have to identify which loan you’d be borrowing before you can borrow a loan from First bank.

The first bank loan, specifically, has the code 89411# or *894# for one to borrow money.

First Advance Loan is a loan system designed for all customers on the payroll of any company or organization. They have the option for this loan until they get their salaries.

The First bank interest rate will depend on the loan one requests. However, it is 5% in general, with a minimum of six months in duration.

Yes, you can borrow from First Bank, but you would have to meet the eligibility laid down and provide all documents that shall be declared when applying for the loan.

You can check the loan eligibility of First Bank by simply dialing 894*11#.

You can get a First Bank loan without collateral if you apply for its First Credit loan or salary advance. These loans are for short-term financing needs and do not require collateral.

With the First Bank app customers can now request loans from the comfort of their living rooms.

Furthermore, you can leverage the ussd code to borrow money from first bank with your phone.

Notably, the interest rates for their loan products are very competitive, flexible repayment terms, and, at times, collateral is not required to take some loans.

You will still need to read through your loan agreement, understand your terms of use, and take a loan only for what you are certain you can pay on time comfortably.

We hope you found this article helpful on how to borrow from First Bank, use the code to borrow money from First Bank and borrow money from the First Bank app.

If you find this article helpful, kindly leave a comment and follow us on our social media handles for more updates.

Facebook at Silicon Africa

Instagram at Siliconafricatech

Twitter at @siliconafritech.

How to get a loan from the First Bank of Nigeria

FirstCredit – First Bank of Nigeria

Loan Application Form – First Bank of Nigeria

How to Borrow Money from Access Bank App in Nigeria | A Step-by-Step Guide

Google Offered 300% Hike in Salary to Retain an Employee

How to Use the African Bank Loan Calculator

FNB Loan Calculator and how to Use it

How to Borrow Money from Opay Without BVN in Nigeria | A Step-by-Step Guide