Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

In this guide, we will explain everything about the Pep loan, including what it is, the eligibility requirements, the criteria, and how to apply for a Pep loan in South Africa.

Pep Money is a convenient and accessible loan option offered by PEP Stores, one of South Africa’s leading retailers.

PEP makes the loan acquisition process exceptionally seamless. You can apply for a Pep loan online or at any nearby Pep Money outlet without any paperwork. Loan amounts range from as little as R1,000 to as much as R50,000.

This flexibility allows you to access emergency funds instantly or opt for a larger loan with a repayment period of up to 24 months. Take the first step towards securing your loan by applying for a Pep loan today!

You will find all the necessary information in this blog post to help you apply for and successfully complete a Pep Money loan.

You only have to keep reading.

Also read: Wonga Loan and How to Apply

Pep Money is a convenient and accessible loan option offered by PEP Stores, one of South Africa’s leading retailers.

Pep Money loans are intended to give those who need money for a variety of reasons—like unforeseen costs, home renovations, or debt consolidation—quick financial support.

Since these loans are usually unsecured—that is, they don’t demand collateral—a larger spectrum of people can easily get them.

If you are a student, you can get study loan in South Africa to help your education. Check it out!

To ensure swift approval and deposit of the loan amount into your bank account, it’s crucial to note the following:

To be eligible for a Pep Money loan, you must meet the following criteria:

Note: There are urgent cash loan in South Africa without salary slip. Their requirements aren’t as much as the Pep Money loan.

Applying for a loan at Pep is incredibly straightforward, offering you two convenient options: online or at a physical store. Upon completing your application, you’ll receive progress notifications and the final loan offer.

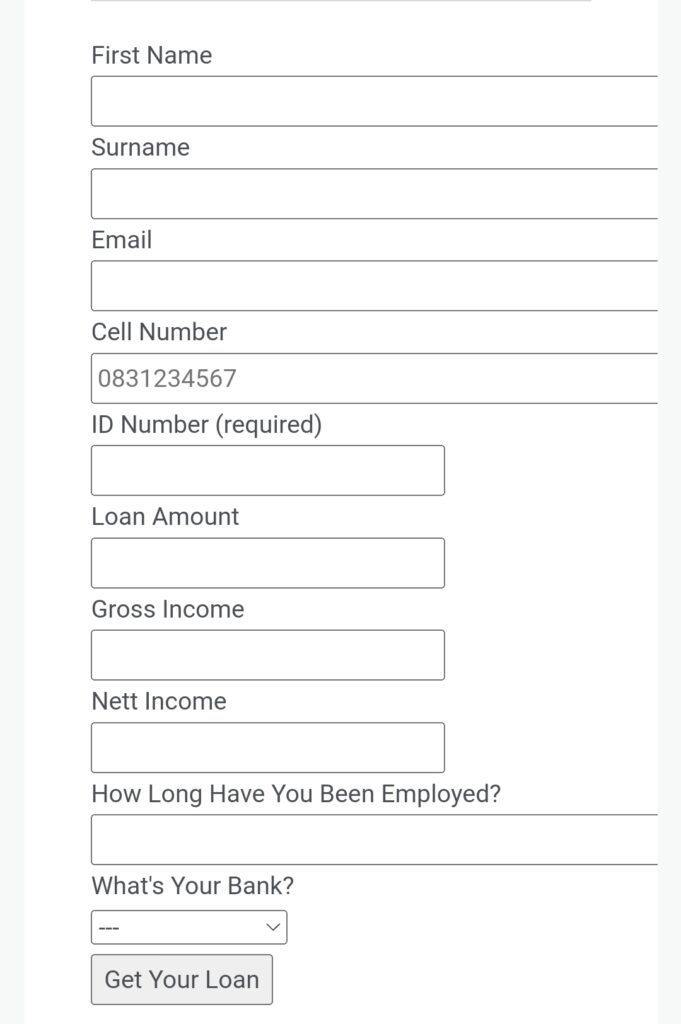

Money Mall’s partnerships with various loan providers in South Africa streamline the process, ensuring quicker access to online loans. Start your application by entering your details in a form that looks like the one below:

Below are the two primary methods to apply for a Pep Money loan in South Africa!

There are many legit online loan apps in South Africa that can be trusted. So, you can also apply for the Pep Money loan online as well.

The following paperwork is required to submit an application for a Pep Money loan:

Also read: Edu Loan: How to Apply and Get it

Your unique situation and creditworthiness will determine the loan amount and terms that Pep Money offers. But generally speaking, loan amounts fall between a few hundred and several thousand Rands. Typically, repayment terms are negotiable and might range from a few months to several years.

Several factors influence Pep loan interest rates. Here are some key considerations:

Also read: Capfin Loan Application: How to Access Capfin Loan

You can apply for a Pep loan either online or at a nearby Pep Money store, making the process convenient and accessible.

They offers loan amounts ranging from as little as R1,000 up to R50,000, providing flexibility to meet varying financial needs.

To qualify for a loan, you must be a South African citizen aged 18 years or older. Employment status can vary, including full-time, part-time, contracted, or self-employed. Additionally, the designated bank account for loan disbursement must be in your name.

Pep strives for a quick approval process, and once approved, the funds can be deposited into your bank account promptly.

The interest rates for loans depend on several factors, including the loan amount, income level, and the choice of credit, life, or funeral cover, which can reduce interest rates.

Yes, Pep Money is a registered financial services and credit provider, ensuring reliability and adherence to regulatory standards

In conclusion, Pep offers a seamless and accessible solution for individuals seeking financial assistance. With flexible loan amounts, convenient application options, and quick approval processes, Pep ensures that customers can access the funds they need when they need them.

Additionally, the partnership with Money Mall and the availability of various insurance options further enhance the borrowing experience, making it easier for customers to manage their loans responsibly.

Whether it’s an emergency expense or a planned investment, Pep provides a reliable financial resource for South African citizens. Apply today to experience the convenience and efficiency of Pep loans.

Interact with us via our social media platforms:

Facebook: Silicon Africa

Instagram: Siliconafricatech

Twitter: @siliconafritech