Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

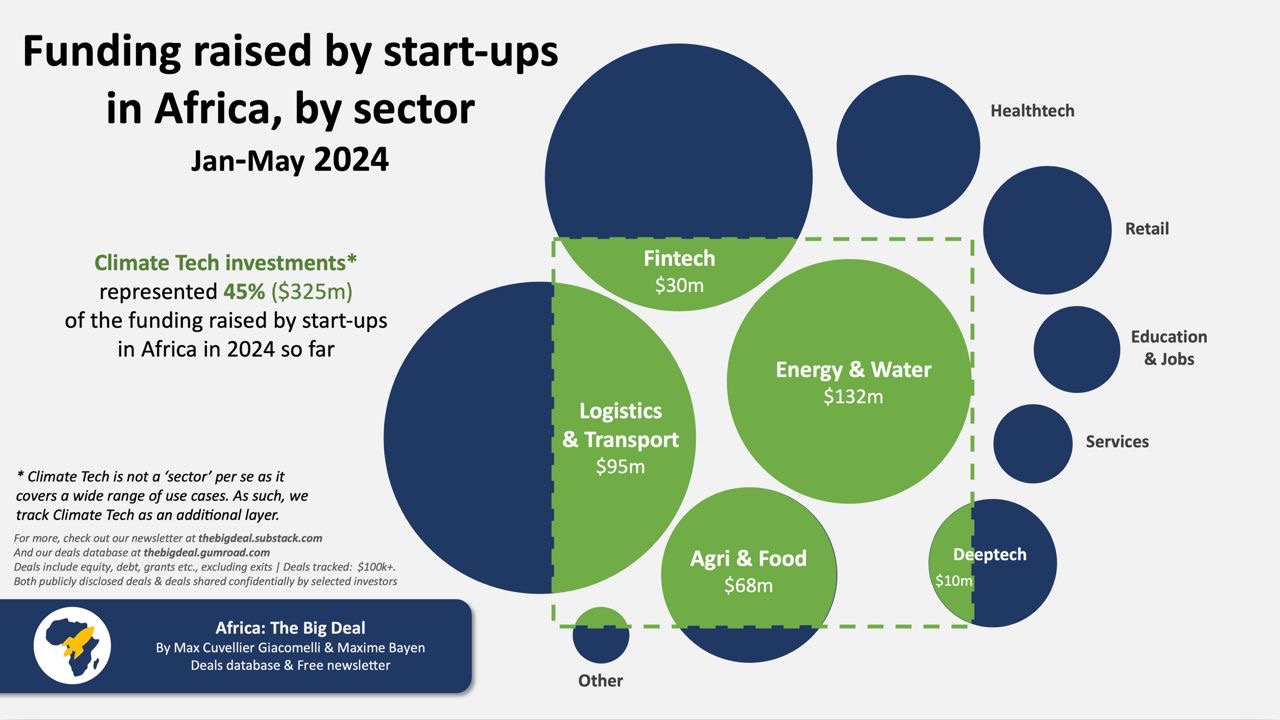

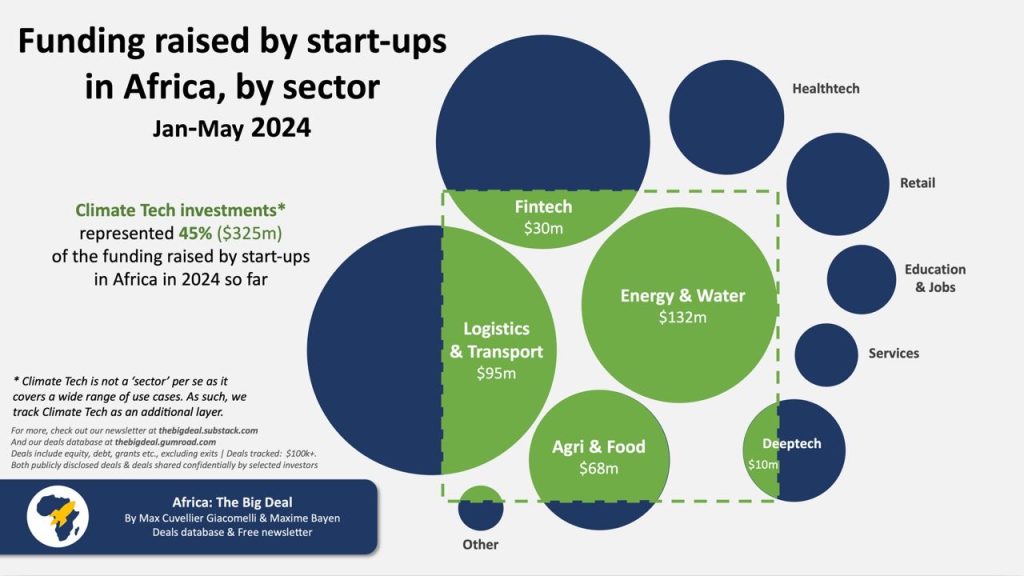

Climate Technology Startup Funding Africa 2024: The influence of climate technologies is becoming more and more evident as the hottest investment destination, according to a report by “Africa: The Big Deal.”

Despite the global slowdown in startup funding, particularly in the previously dominant Fintech sector, Climate Tech has attracted $325 million, representing 45% of all startup investments in Africa so far.

This number represents 45 percent of the total $721 million raised by tech startups on the continent so far, an all-time high for the climate tech sector.

The statistic also effectively makes the sector the most funded sector in 2023. This edges the financial technology sector to attract $158m of the 2024 total, representing just 22 percent of the total.

Climate technology encompasses a wide range of technologies and processes that are designed to address climate change.

This includes everything from renewable energy sources like solar and wind power; to energy efficiency measures like smart grids, and electric vehicles.

Although the funding boom of 2021 and 2022 did not much favor the sector, climate tech funding is one sector that has witnessed continuous and consistent growth over the years.

Also Read: Nigerian Startups Secure 30% of $15 Billion Raised by African Startups in 5 Years

This is in sharp contrast with financial technology which has witnessed dwindling numbers since 2023. Funding into the sector grew from $340 million in 2019 to $344 million in 2020. This number further rose to $613 million in 2021, $959 million in 2022, and $1.1 billion in 2023.

Despite this growth, there has been a great decline in the total share of investments in tech startups on the continent.

However, Climate Tech captured 36% of the total investments. It appears poised for further growth in 2024, already accounting for 45% of investments so far, although surpassing last year’s $1.1 billion investment seems unlikely at this stage.

“The investment boom in 2021 and 2022 did not benefit this space as much as others (such as Fintech), resulting in a drop in its share of total investments: from 25% in 2019 and 32% in 2020 to 14% in 2021 and 21% in 2022.

This share started to pick up again in 2023 (36%) and seems on track to grow again in 2024 45% so far,” the report states.