Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

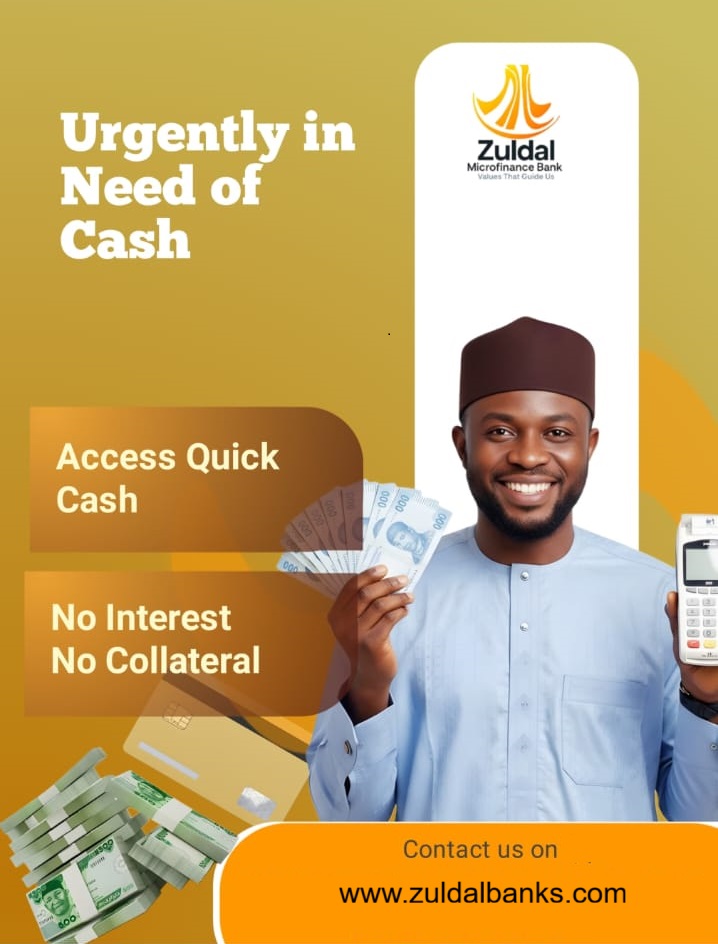

The Central Bank of Nigeria (CBN) has officially declared Zuldal Microfinance Bank an illegal financial institution. According to the CBN, Zuldal Microfinance Bank is operating without any licence or regulatory approval, making it an unauthorised bank in Nigeria. This institution reportedly runs branches in Lagos, Abuja, Kaduna, and Kano but has no official backing from the country’s banking authority.

In a statement released on Wednesday, the CBN clearly said that Zuldal Microfinance Bank is not registered or licensed to function as a microfinance bank. Basically, it has no official permission from the Central Bank of Nigeria to carry out any banking or microfinance activities here. The statement read, “The said Zuldal Microfinance Bank Limited is not a licensed Microfinance Bank and has no authorisation from the Central Bank of Nigeria to operate or carry out any form of banking or microfinance business in Nigeria.”

Read Next: Airtel Malawi has Launched 5G Services

The reason behind this is simple: every financial institution in Nigeria must be properly registered and licensed by the CBN. The law is clear about this, Section 2(1) of the Banks and Other Financial Institutions Act (BOFIA) 2020 says, “ no person shall carry on any banking business in Nigeria except it is a company duly incorporated in Nigeria and holds a valid banking licence issued by the CBN.” This means operating without a valid licence is just not allowed.

Because CBN labels Zuldal Microfinance Bank an illegal financial institution, it warned the public not to get involved in any financial transactions with them. If you do, you’re at your own risk. The CBN also told people to ignore any claims by Zuldal Microfinance Bank saying they are licensed or authorised. The bank wants to make it clear that it’s committed to protecting the financial system and the public from unlicensed and potentially fraudulent outfits like this one.

Checking out things online, Zuldal Microfinance Bank’s website (zuldalmicrofinancebank.com) isn’t working properly, it’s password-protected, so no normal visitor can even see what’s inside. This adds to the suspicion around the company. Some chatter on social media indicates Zuldal Microfinance Bank is quite new and that it held a sort of “grand opening” event at the National Women Centre in Abuja on September 22, 2025.

This warning from the CBN comes at a time when the regulator is working hard to clean up and regulate Nigeria’s financial sector. Recently, the CBN rolled out the Draft Guidelines on the Operations of Automated Teller Machines in Nigeria, aiming to improve how ATMs are managed. These guidelines set minimum standards for ATM deployment, operation, and maintenance, all to make things safer for customers and keep Nigeria’s banking system in line with international best practices.

Read Next: Nigeria Implements World Bank’s FundsChain System

There are also new rules for Point-of-Sale (PoS) banking agents. These updated guidelines are designed to ensure a strong and efficient payment system nationwide. For example, there’s now a cap of N1.2 million on daily transactions for PoS operators, and they can only register with one financial institution at a time.

All these steps show how serious the CBN is about making banking and financial services safer and more reliable. And by labelling Zuldal Microfinance Bank as an illegal financial institution, the CBN is sending a clear message: Nigeria’s financial sector doesn’t tolerate unlicensed operators.

Was this information useful? Drop a nice comment below. You can also check out other useful contents by following us on X/Twitter @siliconafritech, Instagram @Siliconafricatech, or Facebook @SiliconAfrica.